La Liga · Rebuild & Research

Fantasy

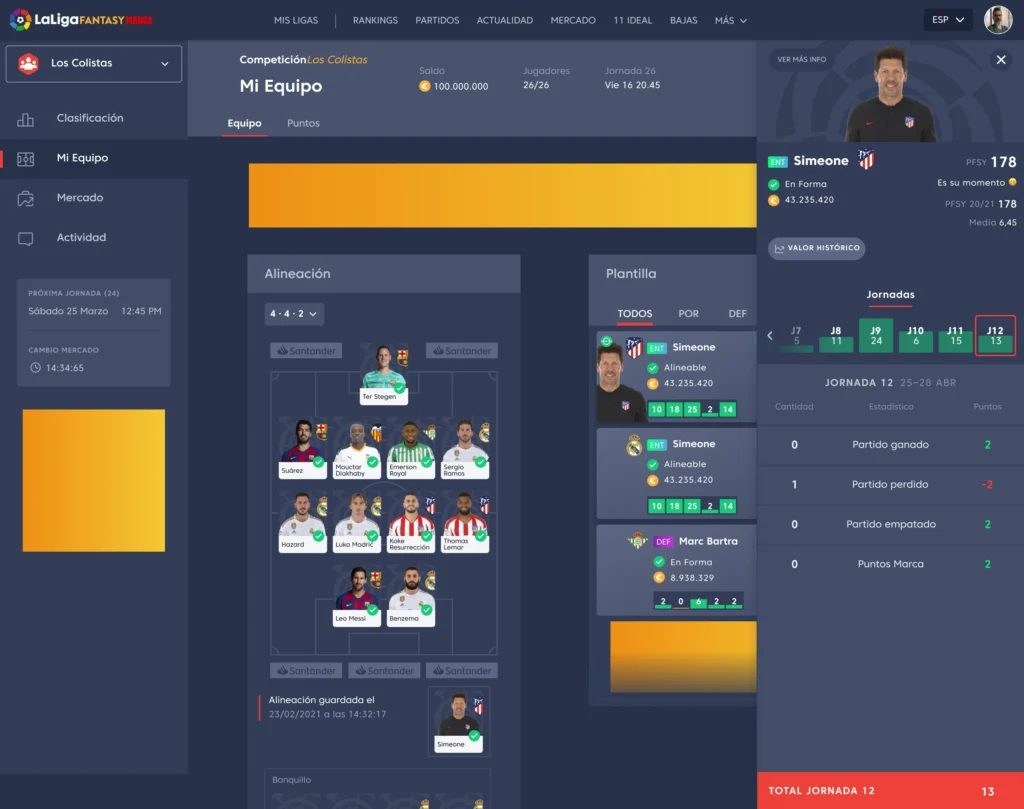

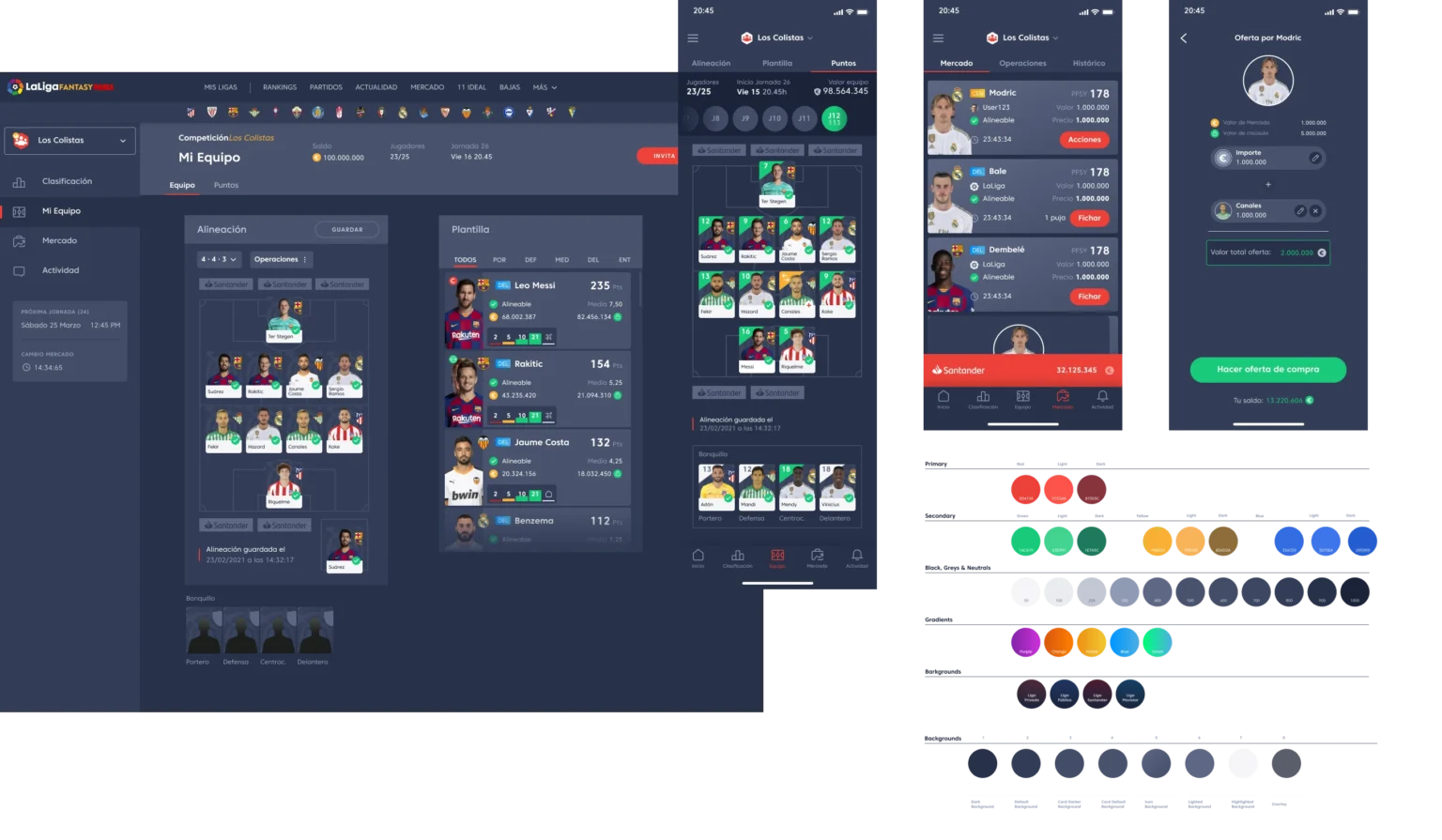

LaLigaFantasy is a mobile game developed in collaboration with the newspaper Marca. We inherited the project from another consultancy, and for some time, the client had been seeking a comprehensive review at the UX/UI level and a reconstruction of the Design System.

AUDIT

Some areas we tackled:

- Dead-end links and incorrect site redirects.

- Text and hierarchy improvements.

- Color guidelines for the Design System.

- Achieving coherence in iconography and typography.

- Proportions and distribution of elements in cards.

- Lack of responsive design in Figma (essential for UI and its integration with the backend).

- Completing and optimizing the Design System, componentization, variants, etc.

OBJETIVES

Audit and review of foundations, design system, functionalities, navigation, journeys, and hierarchy.

SOLUTION

- Benchmark Market Photography

- Establish Design System and Foundations

- Mobile-First System with a Tactical and Scalable Mindset

- User Testing

- Optimization of Navigation Models and User Journeys

- Implementation with Special Event Landing Pages

- High-Fidelity Prototyping

CRAFT

- Figma

- Lookback

- Miro

- Notion

- Adobe After Effects

PROTOTYPING

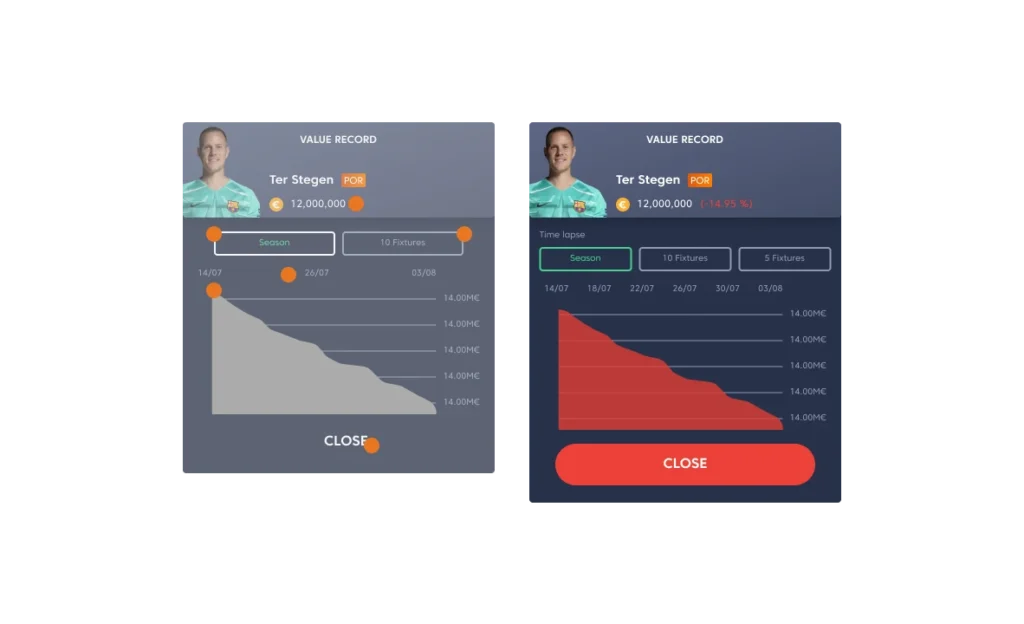

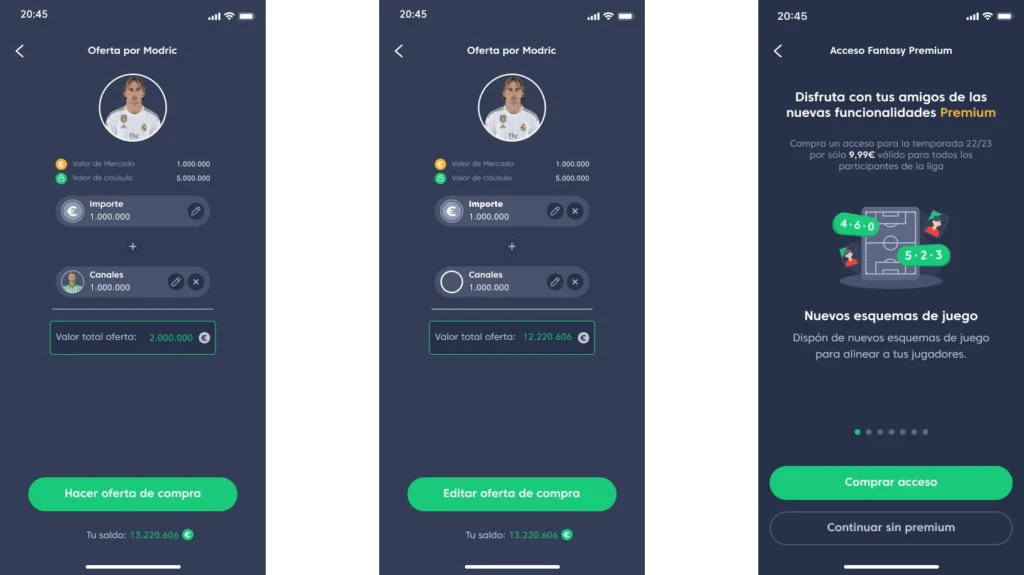

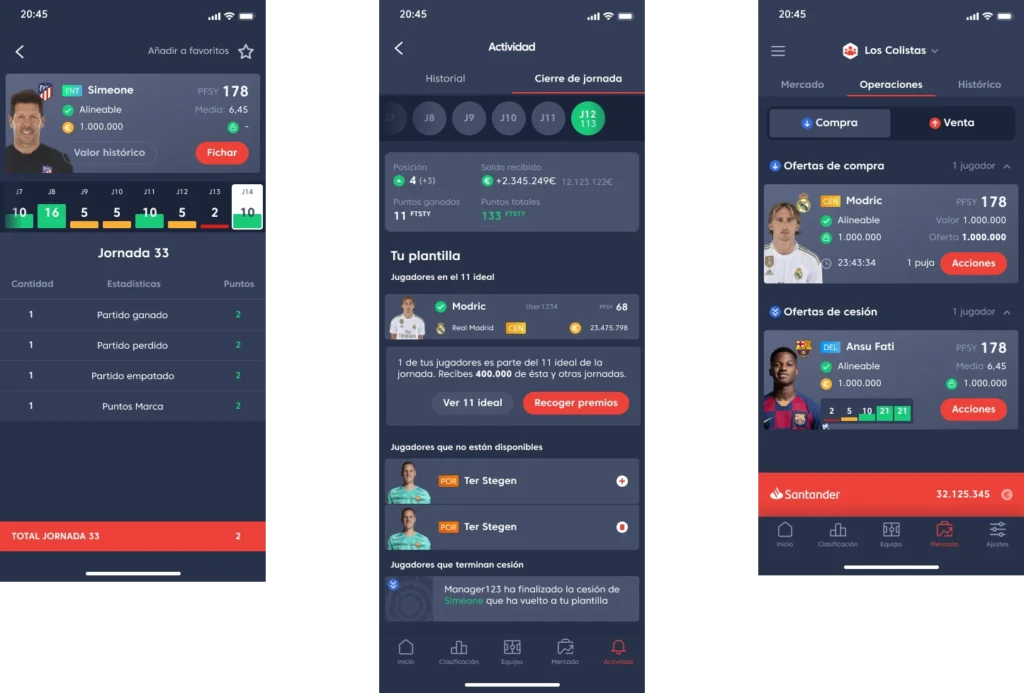

Prototyping was carried out using the inherited material to build on valid foundations. We also prepared the interfaces with a more strategic focus, especially with the Qatar World Cup just around the corner.

In essence, the process ranged from creating new functionalities to simple color adjustments aligned with the library, componentizing elements, creating variants, and finalizing details for integration into the UI.

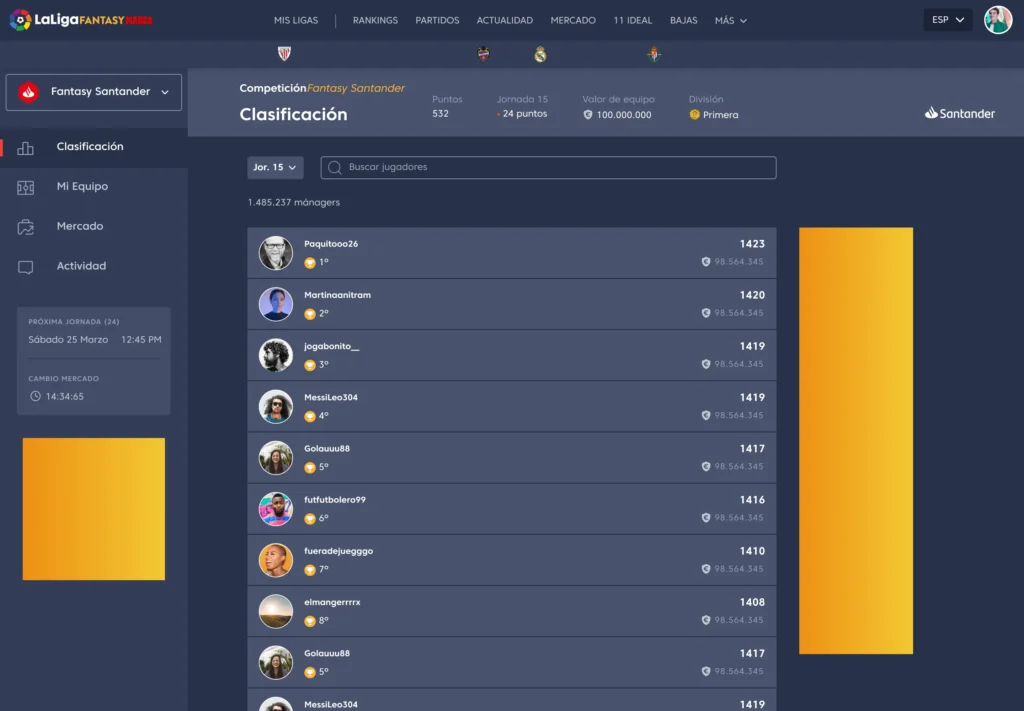

This game was designed for mobile, and it was proposed to forego designing a responsive version for desktop. However, research suggested that being responsive would improve SEO positioning in search engines and provide a new way to analyze and better profile user interactions.

After months of evaluating pros and cons, it was decided that Fantasy would no longer have a desktop version for the 2024–25 season.

La Liga SportsTV

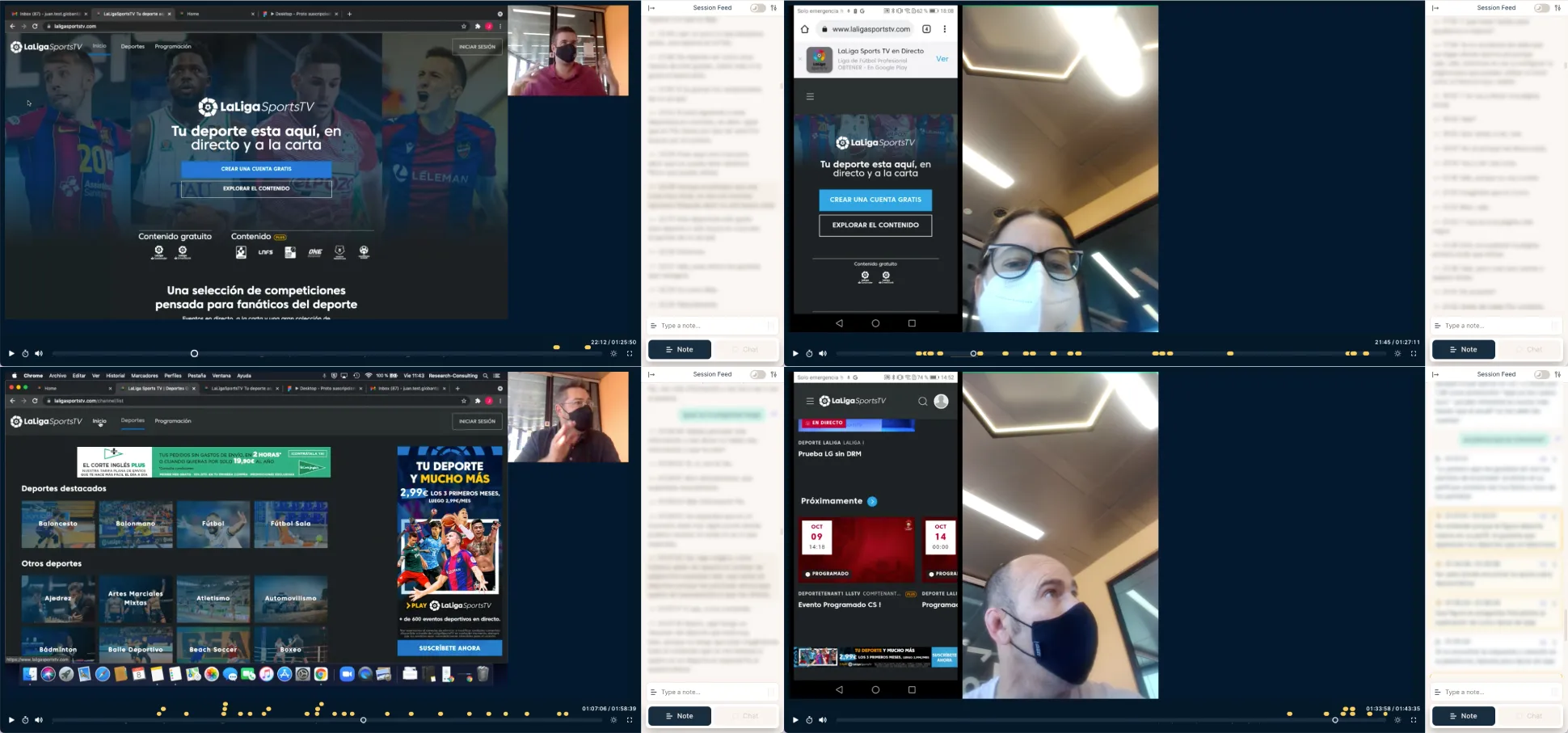

UX monitoring is present across all angles of LaLiga Pass, Fantasy, SportsTV, and more. In this instance, we worked on a Research and Benchmarking project for LaLigaSportsTV.

OBJETIVES

In-depth analysis of competitors’ commercial strategy on two fronts:

- Netflix: Examining various regions in Asia to analyze competing offerings, focusing on strategies and packages from other OTT platforms.

- DAZN: Analysis of its commercial offerings across different parts of Asia, integration with other platforms, and the UX of its subscription process.

SOLUTION

- Benchmark & Market Photography

- Special focus on Features, Prices, and Platforms

- User Interviews, UX Testing, Card Sorting

- Presentation of Results, Hypotheses, Insights, and Conclusions

CRAFT

· Figma

· Miro

· Lookback

· Notion

· Google Slides

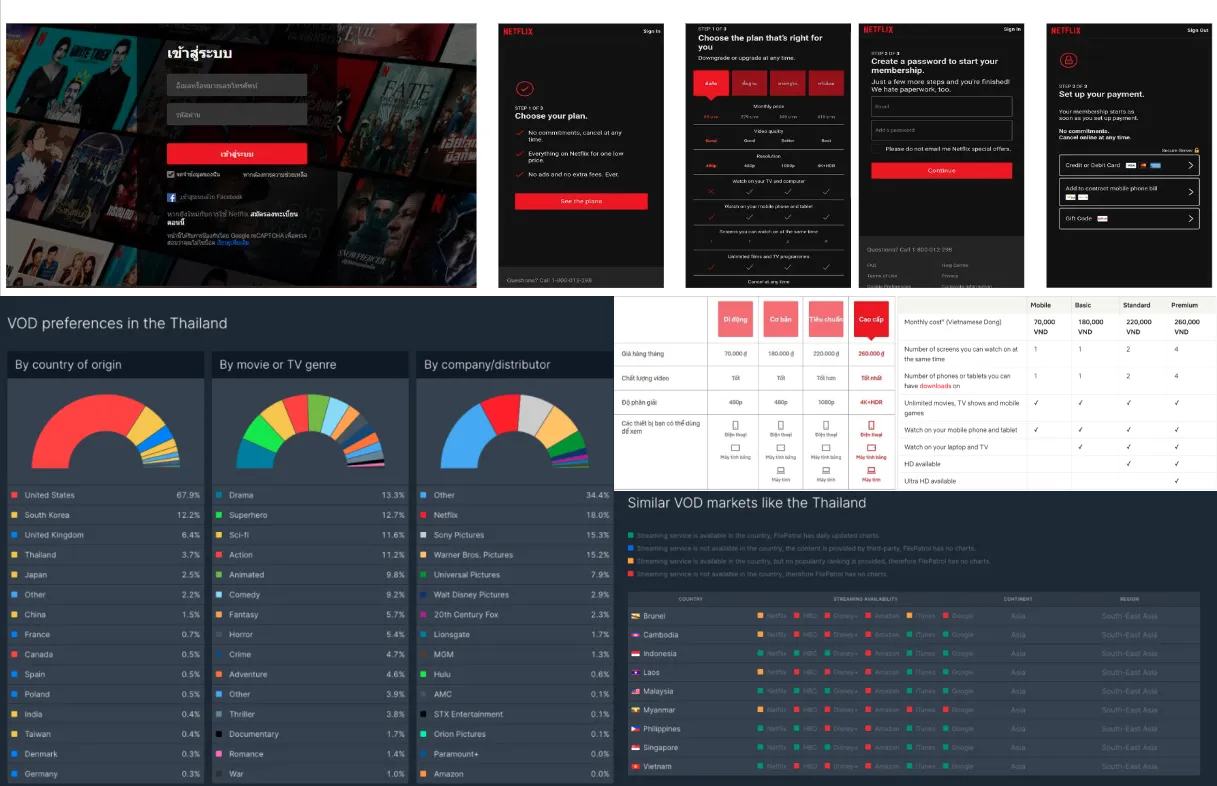

NETFLIX

Netflix was the clear reference, and we wanted to analyze its state in Asia—a continent with as much diversity as distance. We divided the sample into three distinct groups of countries.

This analysis helped us not only understand package offerings and service usability but also to map the technological and social openness to such products.

Research

We mainly investigated commercial offerings, usability, content plans, and user journeys. At the time, Netflix had signed an important agreement with Microsoft, and an entire ecosystem of blogs, posts, and forum debates helped predict a reliable trajectory for programs, platforms, and users.

In conclusion, we identified which parts of the continent were most viable for offering mobile-only options, where these had already been surpassed, and where they hadn’t yet arrived—along with the commercial adaptations this entails.

DAZN

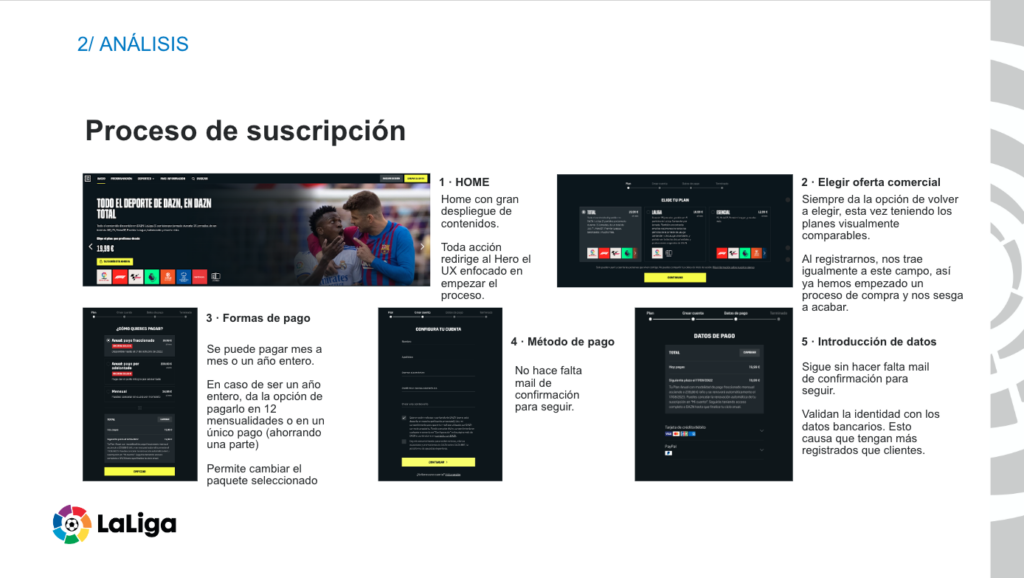

One of the dominant UK OTTs, with heavy European presence, was attempting to enter Spain. Meanwhile, the recent launch of LaLigaSportsTV in Asia positioned it in a similar situation of expansion, making it necessary to find the most relevant references – special care on the UX of the subscription process and platform integration.

We started by reviewing all the subscription options offered compared to other OTTs.

Research

We examined price histories and conducted a comparative analysis against competitors, followed by a UX audit of the connectivity currently offered through Orange and Movistar+.

Finally, we reviewed forums and video reviews to understand UX from more personal angles (issues, complaints, inconsistencies, frustrations, etc.).

We synthesized all findings into a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to confirm some hypotheses and disprove others, creating a clear picture. Above all, it became evident that knowing “what not to do” is as important as knowing “what to do.”

CONCLUSIONS

The results, while confidential, were conclusive and provided a detailed picture of the commercial and cultural acceptance of soccer before, during, and after the Qatar World Cup.

LaLigaSportsTV remained a leading player in this context, and closely following Netflix’s strategies continues to ensure good practices in its expansion efforts.

On the other hand, DAZN was not developing a strong enough strategy to pose a serious threat to LaLigaSportsTV, at least in Southern Europe. Evidence of this is their decision in January 2023 to opt for an agreement with LaLiga instead of investing in competitive infrastructure. This deal began with streaming rights for women’s soccer and later expanded to the men’s division, recently extending through the 2028–29 seasons.